What Is A Sales Strategy Plan? Framework, Process & 2026 Best Practices

What Is A Sales Strategy Plan? Framework, Process & 2026 Best Practices

B2B buying has fundamentally changed. Buyers now complete most of their research independently before ever speaking with sales.

A sales strategy plan in 2026 must account for this shift by enabling self-serve discovery, multi-stakeholder consensus, and precision targeting that prevents irrelevant outreach. Without a structured plan aligned to modern buyer behavior, teams waste resources on mismatched prospects and miss revenue targets.

This guide shows how to build a sales strategy plan that adapts to rep-free buying journeys, accelerates deal velocity, and consolidates your tech stack. You'll learn frameworks Sales Leaders and RevOps teams use to align sales and marketing, reduce friction in long buying cycles, and create measurable pipeline impact. Whether you're a Founder transitioning from founder-led sales or an AE managing complex deals, this approach delivers predictable revenue growth.

Apollo Finds Contacts In Seconds, Not Hours

Tired of spending 4+ hours daily hunting for contact info? Apollo delivers 224M verified contacts with 96% email accuracy. Join 550K+ companies who replaced manual research with instant prospecting.

Start Free with Apollo →Key Takeaways

- Modern sales strategy plans prioritize self-serve buyer journeys and multi-stakeholder consensus over traditional rep-led motions

- ICP alignment prevents wasted outreach—irrelevant messaging actively repels buyers and damages conversion rates

- Integrated sales and marketing systems deliver measurably higher revenue than siloed teams operating separate tools

- Role-specific content libraries and proof assets accelerate deal velocity by addressing stakeholder concerns proactively

- Unified platforms reduce tool complexity and cut costs while improving team productivity and data quality

What Is A Sales Strategy Plan?

A sales strategy plan is a documented framework that defines target customers, revenue goals, sales processes, and resource allocation to achieve predictable growth. It connects market positioning, ideal customer profiles (ICPs), messaging, channel strategy, and team structure into a unified execution roadmap.

In 2026, effective plans incorporate buyer self-service preferences, multi-channel engagement, and cross-functional alignment between sales, marketing, and customer success.

The plan translates business objectives into actionable sales motions. It specifies which accounts to pursue, how to engage them, what content supports each buying stage, and how to measure progress. According to LXA Hub, B2B companies' inability to align sales and marketing teams around processes and technologies costs 10% or more of revenue per year. A comprehensive plan eliminates this misalignment by creating shared definitions, workflows, and success metrics across revenue teams.

Why Do Sales Leaders Need A Sales Strategy Plan In 2026?

Buyer behavior has shifted dramatically. Research from Corporate Visions shows 61% of B2B buyers prefer an overall rep-free buying experience, and 73% actively avoid suppliers that send irrelevant outreach. Sales Leaders must adapt their approach to enable self-directed research while ensuring their team appears on shortlists before the first conversation happens.

Without a strategic plan, teams operate reactively. SDRs chase unqualified leads. AEs spend time on deals that stall. Marketing creates content that sales never uses. A documented strategy creates operational discipline. It defines which ICPs receive outreach, what messaging resonates with each persona, and which sales analytics indicate progress toward revenue goals. This structure becomes critical as buying committees grow larger and cycles extend longer.

What Are The Consequences Of Operating Without A Plan?

Teams without strategic alignment waste significant resources on mismatched activities. Marketing generates leads that don't fit ICP criteria. Sales pursues accounts unlikely to convert. According to Brainstorm Club, organizations with strong sales and marketing alignment achieve 208% higher marketing revenue than those with poor alignment. The gap compounds over time as competitors with tighter execution capture market share.

Operational inefficiency follows strategic misalignment. Reps manually research prospects across disconnected tools. Data quality degrades without governance. Forecasting becomes guesswork. RevOps teams spend time reconciling conflicting reports instead of optimizing processes. Sales performance management requires a foundation of clear strategy, documented processes, and integrated systems.

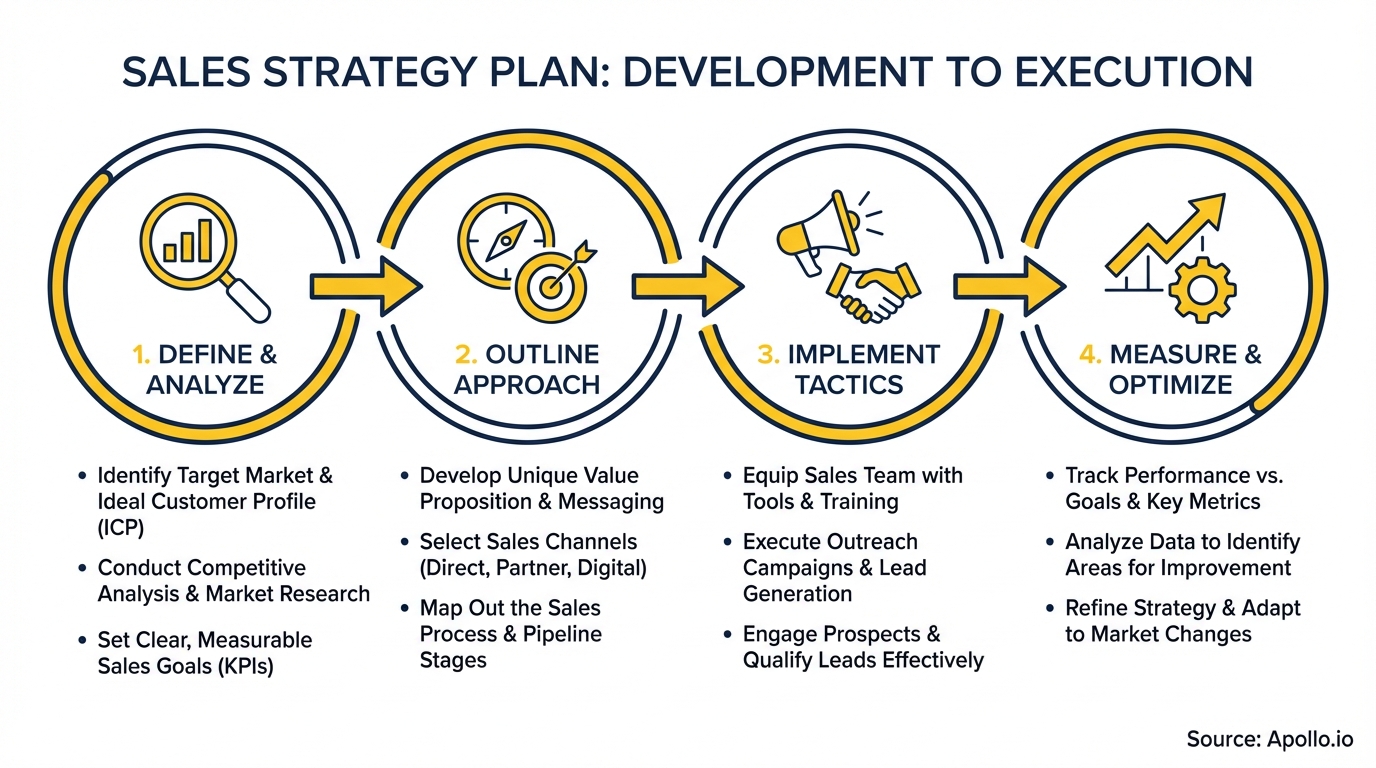

How Do You Build A Sales Strategy Plan That Drives Revenue?

Start with rigorous ICP definition. Document firmographic criteria (industry, company size, geography), technographic signals (current tech stack, buying triggers), and behavioral patterns (content consumption, engagement history).

Map buying committee roles and their specific pain points. This precision prevents the irrelevant outreach that repels modern buyers.

Next, align your go-to-market strategy across teams. Create a single source of truth for messaging, positioning, and value propositions. Define handoff processes between marketing, SDRs, AEs, and customer success. Establish shared metrics that connect activities to pipeline and revenue outcomes. Research from Jifflenow shows companies become 67% better at closing deals when these teams are aligned.

What Components Must Your Plan Include?

| Component | Purpose | Key Elements |

|---|---|---|

| ICP Definition | Focus resources on best-fit accounts | Firmographics, technographics, buying signals, stakeholder map |

| Revenue Goals | Set measurable targets | Bookings, ARR, deal size, win rate, sales cycle length |

| Sales Process | Standardize buyer engagement | Stage definitions, exit criteria, required activities, content assets |

| Channel Strategy | Determine outreach mix | Email, phone, social, events, partners, product-led growth |

| Content Library | Enable self-serve research | Role-based guides, ROI calculators, case studies, implementation roadmaps |

| Tech Stack | Automate and measure execution | CRM, sales engagement, data enrichment, conversation intelligence, analytics |

Struggling to manage prospect data across multiple systems? Consolidate your sales tech stack with Apollo's all-in-one platform. Teams using Apollo report significant time savings by eliminating tool-switching between prospecting, engagement, and pipeline management.

Turn Forecast Guesswork Into Revenue Certainty

Pipeline forecasting a guessing game? Apollo delivers real-time deal visibility and intent signals that make quota predictable. Built-In increased win rates 10% with Apollo's scoring.

Start Free with Apollo →How Do SDRs Execute A Sales Strategy Plan Effectively?

SDRs succeed when they have clear ICP criteria, relevant messaging, and quality contact data. They need lists segmented by persona, industry, and buying stage.

Each segment requires customized sequences that address specific pain points. Generic outreach fails because modern buyers immediately recognize irrelevant messaging and disengage.

Effective SDRs leverage multi-channel sequences that combine email, phone, and social touches. They personalize using account-level insights like recent funding, leadership changes, or technology implementations.

They track engagement signals to prioritize responsive prospects. This approach requires integrated tooling that connects prospecting, engagement, and activity tracking in one workspace.

As one SDR team noted, "We reduced the complexity of three tools into one" using unified platforms.

What Tools Do SDRs Need To Hit Quota?

- Contact database: Verified email addresses and phone numbers for target ICPs with filtering by 65+ criteria

- Sequence automation: Multi-channel cadences with email, phone, and social steps that trigger based on engagement

- Personalization at scale: Dynamic fields that insert company-specific details without manual research

- Activity tracking: Real-time visibility into touches, responses, and pipeline contribution

- Meeting scheduling: Embedded calendar links that eliminate back-and-forth coordination

Spending hours researching prospects manually? Search Apollo's 224M+ business contacts with advanced filters to build targeted lists in minutes instead of days.

How Do AEs And Sales Leaders Manage Complex Deal Cycles?

Account Executives managing enterprise deals face long sales cycles with multiple stakeholders. Each decision-maker has different priorities. Procurement requires security documentation. Finance demands ROI justification. IT needs implementation plans. Legal reviews contract terms. A strategic plan anticipates these requirements and provides ready-to-deploy assets for each stakeholder.

Sales Leaders need visibility into pipeline health across the entire team. They track deal velocity, win rates by segment, and conversion rates at each stage. They identify where deals stall and what content or enablement removes friction. Modern leaders use unified deal management systems that connect prospecting activity to closed revenue, enabling accurate forecasting and resource allocation.

What Content Accelerates Deal Velocity?

- Executive briefings: One-page summaries that communicate strategic value to C-level buyers

- ROI calculators: Quantified business case tools that justify investment to finance stakeholders

- Security documentation: Compliance certifications, data handling policies, and audit reports for IT and security teams

- Implementation roadmaps: Timeline and resource planning guides that reduce perceived risk

- Case studies: Proof from similar companies showing outcomes and lessons learned

- Comparison guides: Objective feature and pricing comparisons that support vendor evaluation

How Should RevOps Teams Structure The Sales Tech Stack?

Revenue Operations leaders face pressure to reduce tool sprawl while maintaining team productivity. The average sales organization uses 10+ disconnected tools for prospecting, engagement, data enrichment, meeting scheduling, and pipeline tracking.

This fragmentation creates data silos, integration maintenance burdens, and significant subscription costs.

The solution is platform consolidation. RevOps teams in 2026 prioritize unified systems that combine prospecting, engagement, enrichment, and analytics in one workspace.

According to customers using consolidated platforms, "We cut our costs in half" while improving data quality and team adoption. The best systems integrate with existing CRMs while providing superior contact data and workflow automation.

What Criteria Should RevOps Use To Evaluate Platforms?

| Criteria | Why It Matters | What To Look For |

|---|---|---|

| Data Coverage | Larger databases reduce prospecting time | 200M+ contacts, global coverage, frequent updates |

| Data Accuracy | Bad data wastes rep time and damages sender reputation | 95%+ email accuracy, verification processes, bounce rate guarantees |

| Workflow Integration | Seamless processes improve adoption | Native CRM sync, Chrome extension, API access |

| Automation Capabilities | Sequences scale outreach without hiring | Multi-channel cadences, AI personalization, engagement triggers |

| Analytics & Reporting | Visibility enables optimization | Pipeline attribution, activity dashboards, forecasting tools |

| Total Cost | Budget efficiency matters at scale | Per-user pricing, included features, no hidden add-ons |

Teams report that "Having everything in one system was a game changer" for adoption and data quality. Single platforms eliminate the friction of context-switching between tools and ensure consistent data across the revenue organization.

Start Building Your Sales Strategy Plan Today

A comprehensive sales strategy plan transforms how revenue teams operate in 2026. It aligns sales and marketing around shared ICPs, creates self-serve buying experiences that modern buyers prefer, and provides role-specific content that accelerates complex deal cycles.

Organizations that implement strategic plans with integrated tooling consistently outperform competitors still operating with fragmented processes and siloed teams.

Begin with ICP definition and buyer journey mapping. Document your sales process and required content assets. Audit your current tech stack for consolidation opportunities. Establish measurement frameworks that connect activities to pipeline outcomes. The most successful teams start with a structured sales kickoff that aligns the entire organization around the new strategy.

Ready to execute your sales strategy plan with a platform that consolidates prospecting, engagement, and pipeline management? Start Your Free Trial and discover why teams at 90K+ companies trust Apollo to drive predictable revenue growth.

Apollo Pays For Itself In Week One

Budget approval stuck on unclear metrics? Apollo delivers measurable pipeline impact from day one. Built-In increased win rates 10% and ACV 10% using Apollo's signals and scoring.

Start Free with Apollo →Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews