Inside Sales Manager Salary: What Top Performers Actually Earn in 2026

Inside Sales Manager Salary: What Top Performers Actually Earn in 2026

Inside Sales Managers lead teams that drive revenue without ever leaving the office. They coach SDRs and BDRs, build outbound strategies, and own pipeline targets that make or break quarterly goals.

But what does this high-stakes leadership role actually pay in 2026? Whether you're a sales leader evaluating compensation packages or an SDR eyeing your next career move, understanding the full pay picture (base salary, commissions, bonuses, and profit sharing) across regions, industries, and experience levels gives you the leverage to negotiate smarter and plan your path to six figures.

Apollo Eliminates 4+ Hours Of Daily Research

Tired of spending 4+ hours daily hunting for contact info? Apollo's 224M verified contacts mean your reps spend time selling, not searching. Join 550K+ companies who've reclaimed their day.

Start Free with Apollo →Key Takeaways

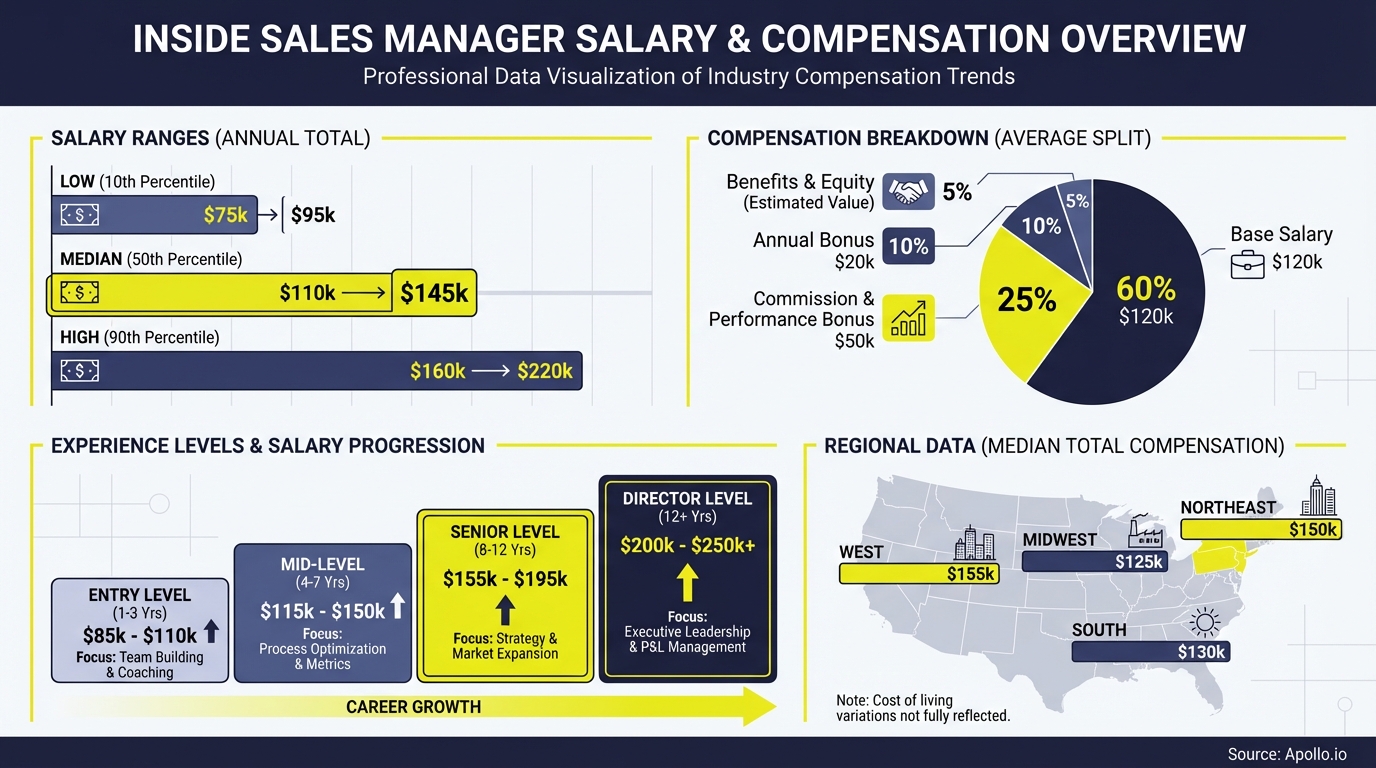

- Inside Sales Managers in the U.S. earn an average base salary of $73,489, with total compensation reaching $102,000+ when commissions and bonuses are included.

- Regional pay varies significantly: tech hubs like San Francisco and New York offer 20-35% higher salaries than national averages, while Canadian managers average $77,300 base with 68% receiving profit sharing.

- Gender pay gaps persist at 34% in some sales sectors, requiring proactive negotiation strategies and transparent compensation policies to address.

- Career progression from entry-level Inside Sales Manager to senior leadership can double your earnings within 5-7 years with the right skill development and industry moves.

- Companies consolidating their sales tech stack report 30-40% cost savings that often translate to larger compensation budgets for high-performing managers.

What Is an Inside Sales Manager?

An Inside Sales Manager is a sales leader who oversees remote or office-based sales teams (typically SDRs, BDRs, and Account Executives) responsible for prospecting, qualifying leads, and closing deals without in-person customer visits. Unlike traditional field sales roles, Inside Sales Managers leverage phone, email, video conferencing, and sales engagement platforms to drive revenue at scale.

These leaders wear multiple hats: they hire and train sales reps, set daily activity targets, analyze pipeline metrics, refine outbound sequences, and collaborate with marketing on lead quality. For SDRs and BDRs aspiring to leadership, the Inside Sales Manager role represents the first major step into management, combining hands-on coaching with strategic revenue planning.

The role has evolved dramatically in 2026. Modern Inside Sales Managers must understand AI-powered sales automation, data enrichment workflows, and multi-channel engagement strategies. They balance human coaching with technology enablement, ensuring their teams hit quota while maintaining healthy activity-to-conversion ratios.

What Is the Average Inside Sales Manager Salary in 2026?

According to industry compensation research, the average annual base salary for Inside Sales Managers in the United States is $73,489, with a median of $60,000. However, total compensation tells a more complete story.

Research by Coursera shows that Inside Sales professionals (including managers) have a median total pay of $102,000 as of October 2025, reflecting base salary plus commissions, bonuses, and profit sharing. This 39% uplift from base to total comp highlights the performance-driven nature of inside sales leadership.

| Compensation Component | Average Amount | Percentage of Total |

|---|---|---|

| Base Salary | $73,489 | 72% |

| Commission | $18,000-$25,000 | 18-24% |

| Bonuses | $5,000-$8,000 | 5-8% |

| Profit Sharing | $3,000-$6,000 | 3-6% |

| Total Compensation | $99,489-$112,489 | 100% |

For Sales Leaders building compensation plans, understanding this pay mix matters. High-performing Inside Sales Managers can push total comp to $130,000+ in enterprise environments, especially when managing teams that exceed revenue targets consistently.

How Do Inside Sales Manager Salaries Vary by Region?

Geographic location creates dramatic salary swings for Inside Sales Managers. Tech hubs and major metros command premium compensation due to higher costs of living and intense competition for sales talent.

What Are the Highest-Paying U.S. Regions for Inside Sales Managers?

| Metropolitan Area | Average Base Salary | Total Compensation Range | Premium vs National Average |

|---|---|---|---|

| San Francisco Bay Area | $95,000-$105,000 | $135,000-$160,000 | +35% |

| New York City | $88,000-$98,000 | $125,000-$145,000 | +28% |

| Seattle | $82,000-$92,000 | $115,000-$135,000 | +22% |

| Austin | $78,000-$86,000 | $110,000-$125,000 | +18% |

| Chicago | $75,000-$83,000 | $105,000-$120,000 | +12% |

| Denver | $72,000-$80,000 | $100,000-$115,000 | +8% |

| Phoenix/Chandler | $68,000-$76,000 | $95,000-$110,000 | +3% |

Remote work in 2026 has complicated regional pay. Many companies now use location-adjusted compensation bands, paying San Francisco rates for remote managers in lower-cost cities, while others maintain strict geographic tiers.

RevOps leaders negotiating offers should clarify whether compensation follows employee location or company headquarters location.

How Do Canadian Inside Sales Manager Salaries Compare to the U.S.?

Data from the 2025 Canadian salary survey indicates that Sales Managers in Canada earned an average base salary of $77,300 in 2024, with 68% receiving profit sharing. This places Canadian compensation roughly 5% higher in base salary compared to U.S. averages, though total comp packages depend heavily on profit-sharing structures.

| Country | Average Base Salary (USD) | Profit Sharing Prevalence | Total Comp Range (USD) |

|---|---|---|---|

| United States | $73,489 | 42% | $99,000-$112,000 |

| Canada | $77,300 | 68% | $105,000-$125,000 |

Canadian managers see higher profit-sharing adoption (68% vs 42% in the U.S.), reflecting corporate structures that favor collective performance incentives. For AEs and Sales Leaders evaluating cross-border opportunities, understanding currency exchange rates, tax implications, and benefits packages (particularly healthcare) matters as much as headline salary numbers.

How Does Inside Sales Manager Compensation Vary by Industry?

Industry selection dramatically impacts earning potential. Technology, SaaS, and financial services consistently offer the highest compensation packages, while retail and traditional manufacturing lag behind.

| Industry | Average Base Salary | Commission Potential | Total Comp Range | Typical Company Size |

|---|---|---|---|---|

| SaaS/Cloud Software | $85,000-$95,000 | 25-35% of base | $120,000-$145,000 | 50-500 employees |

| Cybersecurity | $82,000-$92,000 | 30-40% of base | $115,000-$140,000 | 100-1,000 employees |

| Financial Services | $78,000-$88,000 | 20-30% of base | $105,000-$130,000 | 500+ employees |

| Healthcare Technology | $75,000-$85,000 | 20-28% of base | $100,000-$120,000 | 200-2,000 employees |

| Manufacturing/Industrial | $68,000-$76,000 | 15-22% of base | $85,000-$105,000 | 1,000+ employees |

| Retail/E-commerce | $62,000-$70,000 | 12-18% of base | $75,000-$95,000 | 500+ employees |

SaaS companies dominate the top tier because recurring revenue models create predictable commission structures and higher customer lifetime values. Inside Sales Managers at companies like HubSpot, Salesforce, or emerging AI platforms often earn 40-50% more than peers in traditional industries. The HubSpot inside sales playbook demonstrates how structured coaching and data-driven processes enable managers to hit aggressive targets that unlock maximum variable compensation.

Struggling to hit your team's pipeline targets? Track deals and coach reps in real-time with Apollo's unified deal management platform.

What Are the Key Components of Inside Sales Manager Compensation?

Understanding how your total comp breaks down helps you negotiate smarter and evaluate offers accurately. Inside Sales Manager pay includes four primary components, each with distinct triggers and payout structures.

What Is Base Salary for Inside Sales Managers?

Base salary is the guaranteed annual income paid regardless of performance, typically ranging from $60,000 to $95,000 depending on location, industry, and experience. This forms 65-75% of total compensation for most managers.

Base salary increases with:

- Years of experience: Entry-level managers (0-2 years) start at $60,000-$70,000, while senior managers (8+ years) command $85,000-$105,000+

- Team size: Managing 5-10 reps pays $10,000-$15,000 less than managing 15-25 reps

- Revenue responsibility: Managers owning $2M+ quotas earn 15-25% more base than those managing $500K-$1M targets

- Company stage: Series B-C startups pay 10-20% below public company rates but offer equity upside

How Do Commissions Work for Inside Sales Managers?

Commission structures reward managers for team performance, typically paying 15-35% of base salary when teams hit 100% of quota. Unlike individual contributor commissions that track personal deals, manager commissions tie to aggregate team revenue.

Common commission models include:

- Team quota attainment: Earn 20% of base at 100% quota, with accelerators at 110%+ (earn 1.5x commission rate)

- Individual rep performance: Bonuses based on percentage of reps hitting quota (e.g., $500 per rep who exceeds 90% attainment)

- Pipeline generation: Incentives for SQLs created, meetings booked, or opportunities advanced to later stages

- Revenue growth: Year-over-year growth bonuses for exceeding prior period performance by 15%+

Top-performing managers at high-growth SaaS companies can earn $30,000-$45,000 annually in commissions when their teams consistently exceed targets.

What Types of Bonuses Do Inside Sales Managers Receive?

Bonuses are one-time payments tied to specific achievements beyond standard quota attainment. These typically add $5,000-$12,000 to annual comp.

Common bonus triggers include:

- Annual performance bonuses: 5-10% of base paid for meeting individual OKRs (team retention, process improvements, coaching effectiveness)

- Quarterly MBOs: $1,000-$3,000 per quarter for hitting management-by-objectives targets

- New hire success: $2,000-$5,000 when newly hired reps hit quota within their first 90 days

- Special projects: Bonuses for implementing new sales tech, building training programs, or launching new markets

How Does Profit Sharing Work for Inside Sales Managers?

Profit sharing distributes a percentage of company profits to employees, typically paid annually or quarterly. As noted earlier, 68% of Canadian Sales Managers receive profit sharing compared to 42% in the U.S.

Profit sharing amounts range from $3,000-$8,000 annually at mid-market companies and can reach $15,000-$25,000+ at highly profitable enterprises. These plans vest over time (often 3-5 years) to encourage retention.

For Founders and CEOs building compensation plans, profit sharing creates alignment between manager success and company profitability, while reducing fixed salary expenses during growth phases.

How Do Inside Sales Managers Increase Their Earnings Over Time?

Career progression from entry-level Inside Sales Manager to VP of Sales can double or triple your total compensation within 5-10 years. Understanding the path helps you make strategic moves that accelerate earnings growth.

What Is the Career Trajectory for Inside Sales Managers?

| Career Stage | Years Experience | Team Size | Base Salary Range | Total Comp Range | Key Responsibilities |

|---|---|---|---|---|---|

| Inside Sales Manager (Entry) | 0-2 years | 3-8 reps | $60,000-$70,000 | $85,000-$105,000 | Daily coaching, pipeline reviews, hiring |

| Senior Inside Sales Manager | 3-5 years | 8-15 reps | $75,000-$88,000 | $110,000-$135,000 | Strategic planning, process optimization, training |

| Director of Inside Sales | 5-8 years | 15-30 reps (2-4 managers) | $95,000-$120,000 | $145,000-$180,000 | Multi-team leadership, revenue forecasting, tech stack |

| VP of Sales (Inside Focus) | 8+ years | 30-100+ reps | $130,000-$180,000 | $200,000-$350,000 | Go-to-market strategy, board reporting, executive team |

The fastest path to senior roles combines three elements: consistently exceeding team quotas (110%+ attainment), developing scalable processes that other managers adopt, and building expertise in sales technology and data analytics. SDRs and BDRs who master strategic sales development frameworks position themselves for management roles 18-24 months faster than peers who focus solely on individual quota attainment.

What Skills Increase Inside Sales Manager Salaries Most?

Specific competencies command salary premiums of 15-30% in 2026:

- Revenue operations expertise: Understanding data enrichment, sales funnel optimization, and CRM architecture adds $12,000-$20,000 to base salary

- AI and automation fluency: Managers who implement AI-powered prospecting and sequence automation earn 18-25% more than those relying on manual processes

- Cross-functional collaboration: Proven ability to align with marketing, product, and customer success teams on account-based strategies

- Data analytics: Building custom dashboards, analyzing conversion funnels, and predictive pipeline modeling

- Coaching methodology: Formal training in sales coaching frameworks (Sandler, Challenger, MEDDIC) and adult learning principles

For Sales Leaders upskilling their teams, investing in modern sales tech stack training delivers immediate ROI through higher rep productivity and faster ramp times.

Apollo Finds Your Best-Fit Buyers Instantly

Wasting hours qualifying leads that never convert? Apollo's intent signals and ICP scoring surface prospects actively searching for your solution. Built-In increased win rates 10% by focusing on ready-to-buy accounts.

Start Free with Apollo →What Gender Pay Gaps Exist for Inside Sales Managers?

Pay equity remains a critical issue in sales leadership. According to ISM's 2025 Salary Survey, the gender salary gap in supply management widened to 34% in 2024, with men earning an average of $144,384 compared to $107,878 for women. While this data covers broader management roles, similar patterns appear in inside sales leadership.

Why Do Gender Pay Gaps Persist in Inside Sales Management?

Research identifies four primary drivers:

- Negotiation disparities: Women negotiate initial offers 23% less aggressively than men, creating a base salary gap that compounds over time

- Commission structure bias: Variable comp tied to team size disadvantages women, who more often manage smaller teams or newer territories

- Promotion timing: Women receive first management promotions 14 months later on average than male peers with identical performance

- Transparency gaps: Companies without published compensation bands see 2.3x larger gender gaps than those with transparent pay ranges

How Can Inside Sales Managers Address Gender Pay Gaps?

For individuals negotiating compensation:

- Research market rates thoroughly: Use multiple salary databases and peer networks to establish realistic ranges before negotiating

- Negotiate total comp, not just base: Push for higher commission rates, larger bonuses, and equity if base salary hits resistance

- Request written justification: Ask employers to document how they arrived at your offer relative to internal peers and market data

- Time negotiations strategically: Negotiate during offer stage and at promotion, not during annual reviews where budgets are fixed

For Sales Leaders and CEOs building equitable structures:

- Publish compensation bands: Transparent ranges reduce negotiation gaps and improve trust

- Audit pay regularly: Quarterly reviews identifying unexplained gaps above 5% trigger immediate correction plans

- Standardize promotion criteria: Objective scorecards for management readiness eliminate subjective bias

- Equal commission potential: Ensure women manage similarly sized teams and territories with equivalent revenue opportunities

How Does Company Size Impact Inside Sales Manager Salaries?

Organizational scale creates distinct compensation profiles. Startups offer equity and rapid advancement but lower cash comp, while enterprises provide stability and higher base salaries but slower career progression.

| Company Size | Average Base Salary | Commission Potential | Equity/RSUs | Career Velocity | Tech Stack Budget |

|---|---|---|---|---|---|

| Startup (10-50 employees) | $62,000-$75,000 | 25-35% of base | 0.25-1.0% equity | Very Fast (12-18 months) | Limited ($5K-$15K/year) |

| Growth Stage (50-250 employees) | $70,000-$85,000 | 20-30% of base | 0.1-0.5% equity | Fast (18-30 months) | Moderate ($15K-$40K/year) |

| Mid-Market (250-1,000 employees) | $75,000-$92,000 | 18-25% of base | RSUs ($10K-$25K/year) | Moderate (30-48 months) | Substantial ($40K-$100K/year) |

| Enterprise (1,000+ employees) | $82,000-$105,000 | 15-22% of base | RSUs ($20K-$50K/year) | Slow (48-72 months) | Extensive ($100K-$500K+/year) |

The tech stack budget column matters more than most managers realize. Companies that consolidate multiple tools into unified platforms like Apollo report 30-40% cost savings, often reallocating those dollars to higher manager compensation and team expansion.

As one RevOps leader shared: "Having everything in one system was a game changer" (Cyera customer). Managers who drive tool consolidation initiatives often receive special bonuses or accelerated promotions for delivering measurable cost savings.

Tired of managing five disconnected sales tools? Consolidate your tech stack with Apollo's all-in-one platform and cut costs by 40%.

What Benefits and Perks Complement Inside Sales Manager Salaries?

Total rewards extend beyond cash compensation. Benefits packages can add $15,000-$35,000 in annual value, making them critical evaluation criteria when comparing offers.

What Are Standard Benefits for Inside Sales Managers?

| Benefit Category | Typical Offering | Annual Value | Prevalence |

|---|---|---|---|

| Health Insurance | Medical, dental, vision (80-100% employer-paid) | $8,000-$15,000 | 95% |

| Retirement Matching | 401(k) with 3-6% match | $2,500-$6,000 | 82% |

| PTO/Vacation | 15-25 days annually | $4,000-$8,000 | 100% |

| Professional Development | Training budgets, conference attendance | $2,000-$5,000 | 68% |

| Remote Work Stipend | Home office equipment, internet | $1,200-$3,000 | 72% |

| Wellness Programs | Gym memberships, mental health resources | $800-$2,000 | 54% |

What Perks Do High-Growth Companies Offer Inside Sales Managers?

Competitive employers differentiate through creative perks:

- President's Club trips: All-expenses-paid vacations for top-performing managers and their teams

- Sabbaticals: 4-6 week paid breaks after 5-7 years of service

- Stock refreshers: Annual equity grants beyond initial hire packages, often worth $10,000-$30,000

- Flexible schedules: Results-only work environments where managers set their own hours

- Sales tool budgets: $5,000-$15,000 annually to purchase technologies that improve team performance

- Education reimbursement: MBA or executive education programs (up to $20,000/year)

How Can Inside Sales Managers Negotiate Higher Salaries?

Effective negotiation combines market research, performance documentation, and strategic timing. Whether you're negotiating a new offer or seeking a raise, these tactics maximize outcomes.

What Should Inside Sales Managers Research Before Negotiating?

Build a comprehensive data foundation:

- Market rates: Gather salary data from 3-5 sources (Glassdoor, Levels.fyi, peer networks, recruiters) for your specific location and industry

- Internal comparables: Research what peers at your company earn through anonymous conversations or equity database sites

- Total comp benchmarks: Calculate your current total compensation (base + commission + bonuses + benefits) to compare accurately

- Company financial health: Review recent funding rounds, revenue growth, or public financials to gauge negotiation leverage

- Replacement cost: Estimate what it would cost to hire and ramp your replacement (typically 6-12 months of salary plus lost productivity)

What Tactics Work Best When Negotiating Inside Sales Manager Compensation?

Proven negotiation strategies include:

- Lead with performance data: Document team quota attainment, rep retention rates, and process improvements with specific metrics

- Request a range first: Ask "What range did you have in mind?" before stating your expectations

- Anchor high but realistic: Start 15-20% above your target to create negotiation room

- Negotiate multiple variables: If base salary stalls, push for higher commission rates, signing bonuses, or accelerated equity vesting

- Use competing offers strategically: Mention other opportunities without threatening, creating urgency without burning bridges

- Get everything in writing: Ensure verbal commitments for raises, promotions, or bonuses appear in offer letters or employment agreements

For AEs transitioning into management, the first manager offer sets your earning trajectory for years. Negotiating an extra $5,000 in base salary compounds to $50,000+ in lifetime earnings when factoring in percentage-based raises and commission calculations.

When Should Inside Sales Managers Negotiate Compensation?

Timing creates leverage:

- During initial offer: Maximum leverage before accepting; companies expect negotiation

- At promotion: Role changes justify significant increases (15-25% base + higher commission rates)

- After major wins: Negotiate within 30-60 days of exceeding annual targets or launching successful initiatives

- During annual reviews: Less ideal (budgets are fixed) but document requests for next cycle

- When receiving competing offers: External validation of market value creates urgency

What Job Market Trends Impact Inside Sales Manager Salaries in 2026?

Several macroeconomic and industry shifts are reshaping Inside Sales Manager compensation:

How Is AI Automation Changing Inside Sales Manager Roles and Pay?

AI tools are transforming what managers spend time on and which skills command premiums. Managers who leverage AI for routine tasks (call summaries, email drafting, pipeline forecasting) can coach 40% more hours weekly, driving higher team performance and justifying 15-20% salary premiums.

Companies investing heavily in AI sales tools often pay managers more to implement and optimize these systems. The shift rewards technical fluency: managers who can build custom AI prompts, analyze conversation intelligence data, and train reps on AI-assisted workflows are becoming indispensable.

What Impact Does Remote Work Have on Inside Sales Manager Salaries?

Remote work has created two distinct compensation models. Some companies maintain location-based pay (San Francisco rates for SF residents, Phoenix rates for Phoenix residents), while others adopt role-based pay (same rate regardless of location).

The latter model typically settles at 75-85% of top-tier metro rates.

Remote-first companies report 25% larger candidate pools, increasing competition and potentially suppressing salary growth. However, managers with proven remote leadership skills (asynchronous communication, virtual coaching, distributed team building) command 10-15% premiums due to scarcity.

How Are Hiring Trends Affecting Inside Sales Manager Demand?

According to Coursera, the U.S. Bureau of Labor Statistics projects 1.8 million job openings in sales occupations each year between 2024 and 2025. This sustained demand creates upward pressure on manager salaries, particularly in high-growth sectors like cybersecurity, AI infrastructure, and healthcare technology.

Companies struggling to hire and retain sales talent are increasing manager compensation to improve team stability. Organizations with manager turnover above 25% annually now pay 12-18% premiums to attract experienced leaders who can reduce churn.

Frequently Asked Questions About Inside Sales Manager Salaries

How Much Do Entry-Level Inside Sales Managers Earn?

Entry-level Inside Sales Managers with 0-2 years of management experience typically earn $60,000-$70,000 in base salary, with total compensation ranging from $85,000-$105,000 when including commissions and bonuses. Geographic location and industry significantly impact these figures, with tech hubs paying 20-30% more than national averages.

What Is the Difference Between Inside Sales Manager and Sales Manager Salaries?

Inside Sales Managers (remote/office-based teams) earn comparable base salaries to general Sales Managers but often receive lower commission rates due to smaller deal sizes. Field Sales Managers overseeing outside sales teams typically earn 15-25% more in total compensation due to larger territories and higher-value enterprise deals.

However, Inside Sales Manager roles offer better work-life balance and lower travel requirements.

Do Inside Sales Managers Earn More Than Senior SDRs?

Yes, Inside Sales Managers earn 35-50% more in total compensation than top-performing senior SDRs. While elite SDRs can reach $90,000-$110,000 in total comp through aggressive commission structures, Inside Sales Managers average $99,000-$112,000 with more stable income (higher base, lower variable).

The management path trades personal quota stress for team leadership responsibilities.

How Often Do Inside Sales Managers Receive Raises?

Most Inside Sales Managers receive annual merit increases of 3-5% for meeting expectations, with high performers earning 8-12% raises. Promotions to senior manager or director roles typically deliver 15-25% base salary increases.

Changing companies remains the fastest way to increase compensation, with external moves averaging 20-35% total comp increases versus 10-15% for internal promotions.

What Certifications Increase Inside Sales Manager Salaries?

Valuable certifications include: Certified Sales Leadership Professional (CSLP), Sandler Sales Management, Revenue Operations Certified (from Pavilion), and platform-specific certifications (Salesforce Advanced Administrator, HubSpot Sales Hub). These credentials add $5,000-$12,000 to base salary and signal expertise during negotiations.

Technical certifications in data analytics or sales automation often deliver higher ROI than general sales certifications.

How Do Inside Sales Manager Salaries Compare Internationally?

U.S. Inside Sales Managers earn the highest absolute salaries globally.

Canadian managers earn 5% more in base salary but comparable total comp when adjusted for currency. European managers (UK, Germany, Netherlands) earn 15-25% less in nominal terms but enjoy stronger benefits (healthcare, pension, vacation).

APAC markets (Singapore, Australia) pay 10-20% below U.S. rates with high variance by city.

Take Control of Your Inside Sales Manager Career and Compensation

Inside Sales Manager salaries in 2026 reflect a complex mix of base pay, commissions, bonuses, and profit sharing that varies dramatically by region, industry, company size, and individual performance. Whether you're earning $85,000 as an entry-level manager or targeting $150,000+ as a senior leader, understanding the full compensation landscape empowers you to negotiate effectively, choose the right opportunities, and build a career trajectory that maximizes your earning potential.

The highest earners combine three elements: they join high-growth industries (SaaS, cybersecurity, healthcare tech), develop scarce skills (AI automation, revenue operations, data analytics), and consistently deliver results that exceed team quotas. They also recognize that tool consolidation and operational efficiency directly impact their value to employers. Companies that streamline their sales tech stack can reallocate budgets to competitive manager compensation, creating win-win scenarios.

For Sales Leaders, RevOps teams, and Founders building inside sales organizations, transparent compensation structures, regular pay equity audits, and investment in manager development deliver measurable ROI through lower turnover and higher team performance. The managers who drive the most value in 2026 are those who master both the art of coaching and the science of sales technology.

Whether you're negotiating your next offer, planning a career transition, or building compensation structures for your team, use the data, frameworks, and strategies in this guide to make informed decisions that drive your success. The inside sales profession continues to evolve rapidly, and managers who stay ahead of trends in AI automation, remote leadership, and data-driven coaching will command premium compensation for years to come.

Ready to lead a high-performing inside sales team? Get Leads Now with Apollo's all-in-one platform that consolidates prospecting, engagement, and pipeline management into one workspace. Join 550K+ companies and 2M+ users who have reduced tool complexity and increased revenue with Apollo.

Prove Apollo's ROI In Your First Month

Budget approval stuck on unclear metrics. Apollo delivers measurable pipeline impact from day one—track every dollar from prospect to close. Customer. io achieved 50% YoY growth with clear attribution.

Start Free with Apollo →Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews