How to Calculate Sales Commission: Formulas and Examples That Work

How to Calculate Sales Commission: Formulas and Examples That Work

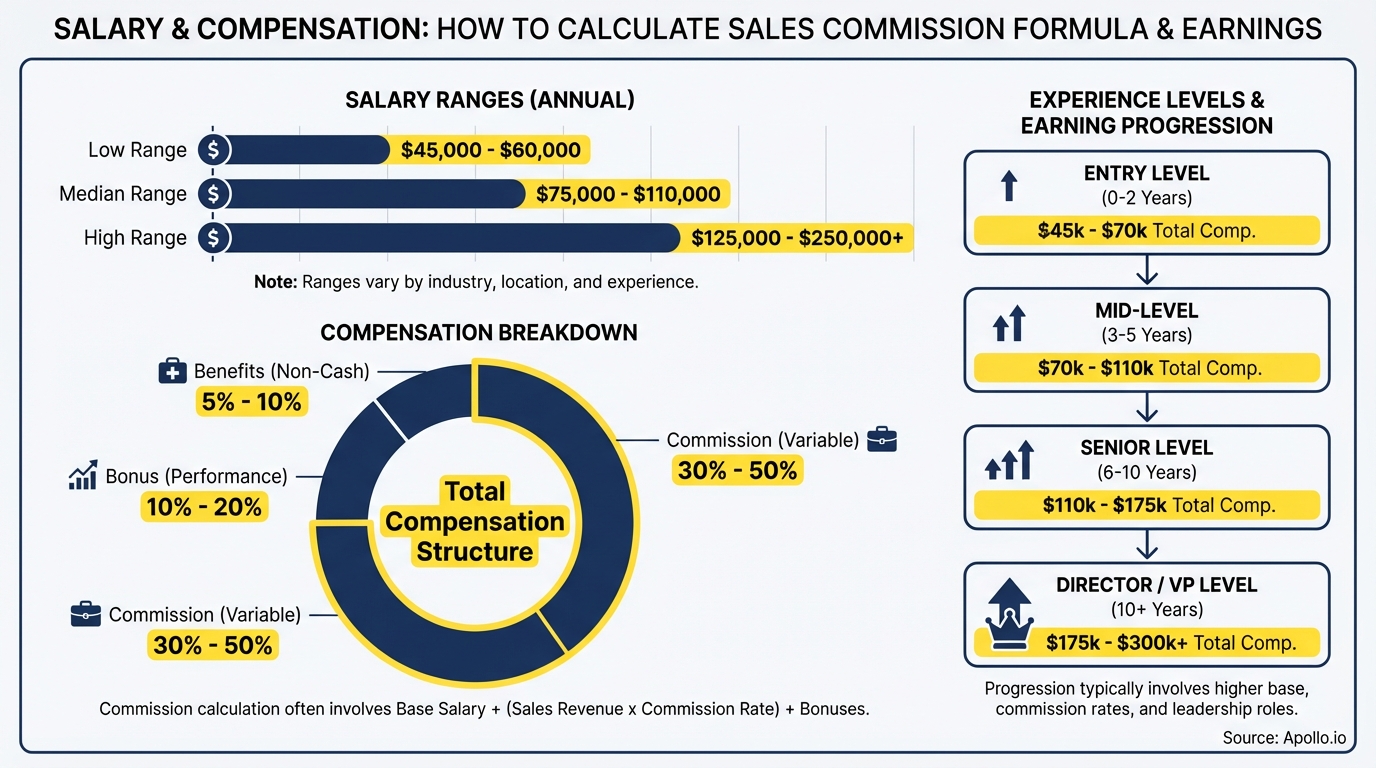

Calculating sales commissions correctly drives team motivation and prevents payroll disputes. Sales leaders in 2026 need precise formulas that align compensation with performance across different commission structures. Whether you manage SDRs, AEs, or enterprise sellers, understanding commission calculations ensures fair pay and predictable revenue. This guide breaks down every commission structure with step-by-step formulas, worked examples, and compliance considerations that sales development teams actually use.

Apollo Finds Your Exact Buyers Instantly

Tired of low lead volume killing your quota? Apollo delivers 224M+ verified contacts with 96% email accuracy so you stop sorting and start selling. Join 550K+ companies hitting their numbers.

Start Free with Apollo →Key Takeaways

- Master five core commission formulas: straight commission, tiered rates, residual structures, salary-plus-commission, and draw against commission

- Tiered commission structures boost high performance by rewarding sellers who exceed quotas with escalating percentages

- California commission laws require special overtime calculations that impact total compensation rates

- RevOps teams save hours monthly by automating commission tracking through integrated sales platforms

- Compliance mistakes in commission calculations expose companies to legal disputes and back pay claims

What Is a Sales Commission Formula?

A sales commission formula is a mathematical calculation that determines how much a salesperson earns based on their sales performance. The formula multiplies total sales by a predetermined commission rate to calculate earnings. Accounting Corner identifies several primary structures including straight commission, salary plus commission, tiered commission, and residual commission, each with distinct calculation methods.

The basic formula works like this: Commission = Sales Revenue × Commission Rate. For example, if an AE closes $50,000 in deals at a 10% commission rate, they earn $5,000.

More complex structures layer additional variables like quota attainment, product margins, or customer retention.

What Are the Different Types of Commission Structures?

Five primary commission structures dominate B2B sales in 2026:

| Structure Type | Formula | Best For |

|---|---|---|

| Straight Commission | Total Sales × Rate | Pure hunters, field sales |

| Salary + Commission | Base Salary + (Sales × Rate) | Most B2B roles, balanced risk |

| Tiered Commission | Different rates at sales thresholds | Quota-driven teams, SDRs |

| Residual Commission | Ongoing % of customer lifetime value | SaaS, recurring revenue models |

| Draw Against Commission | Advance repaid from future earnings | New hires, seasonal businesses |

According to business mathematics research, tiered structures are particularly common, where sales up to $100,000 earn 2% commission, the next $100,000 earns 3%, and sales above $200,000 earn 4%.

How Do You Calculate Tiered Commission Formulas?

Tiered commission formulas apply different percentage rates to different sales levels, rewarding higher performance with escalating rates. Calculate each tier separately, then add them together for total commission.

Example calculation: An SDR manager sets these tiers: 0-$50K at 5%, $50K-$100K at 7%, above $100K at 10%. If a rep closes $120,000:

- Tier 1: $50,000 × 5% = $2,500

- Tier 2: $50,000 × 7% = $3,500

- Tier 3: $20,000 × 10% = $2,000

- Total Commission: $8,000

This structure motivates reps to push past quota thresholds. Sales leaders report that tiered plans drive 25-40% more revenue from top performers compared to flat-rate structures.

What Are the Pitfalls of Tiered Commission Plans?

Three common mistakes undermine tiered commission effectiveness:

- Too many tiers: Complexity confuses reps and reduces motivation

- Unrealistic thresholds: If only 5% of reps hit top tiers, the structure fails

- Poor communication: Reps need clear visibility into current tier status and earnings

Struggling to track pipeline progress across your team? Get complete visibility with Apollo's deal management platform that shows real-time quota attainment.

Turn Guesswork Into Predictable Pipeline

Forecasting unreliable because deal stages aren't visible in real time. Apollo gives you live pipeline insights and intent signals so you stop guessing and start predicting revenue. Join 550K+ companies closing with confidence.

Start Free with Apollo →How Do Sales Leaders Calculate Residual Commissions?

Residual commission formulas pay sellers ongoing percentages based on customer retention and recurring revenue. The calculation multiplies monthly recurring revenue (MRR) by the residual commission rate for as long as the customer remains active.

Basic residual formula: Monthly Commission = Customer MRR × Residual Rate

Example: An AE closes a customer paying $5,000/month. With a 5% residual rate, the AE earns $250 every month that customer stays active. Over 24 months, that single deal generates $6,000 in total commissions.

What Makes Residual Structures Effective for SaaS Teams?

Residual commissions align seller behavior with customer success:

- Reps focus on ideal customer profile (ICP) fit, not just closing volume

- Account Executives stay engaged post-sale to prevent churn

- Long-term customer value becomes the priority over short-term wins

SaaS companies using residual structures report 30-50% lower first-year churn rates. The ongoing income stream rewards reps for quality deals and post-sale relationship building that drives revenue operations efficiency.

How Do RevOps Teams Handle Commission Compliance?

Commission compliance requires calculating regular rates correctly for overtime pay, particularly in states like California. California commission pay laws mandate that commissions be included when determining the regular rate for overtime calculations.

California overtime formula:

- Regular Rate = (Base Salary + Commissions) ÷ Total Hours Worked

- Overtime Rate = Regular Rate × 1.5 (or 2x for double-time)

Example: A rep earns $4,000 base salary plus $2,000 commission in a month with 180 hours worked. Regular rate = $6,000 ÷ 180 = $33.33/hour. If they work 10 overtime hours, overtime pay = $33.33 × 1.5 × 10 = $500 additional compensation.

What Documentation Do RevOps Leaders Need?

RevOps teams must maintain these records to ensure compliance:

| Document Type | Retention Period | Purpose |

|---|---|---|

| Commission plan terms | Duration of employment + 3 years | Dispute resolution |

| Sales transaction records | 7 years | Audit trail, tax compliance |

| Commission calculations | 7 years | Verify accuracy, legal defense |

| Payment confirmations | 7 years | Proof of payment |

Managing commission tracking across multiple tools and spreadsheets? Consolidate your go-to-market operations with Apollo's unified platform that connects pipeline data with performance metrics.

How Do Sales Leaders Implement Commission Formulas?

Successful commission implementation follows these steps:

- Define clear objectives: Align commission structure with business goals (new logo acquisition, expansion revenue, retention)

- Set realistic quotas: Base targets on historical performance data, not aspirational goals

- Document everything: Create written commission plans with specific calculation examples

- Automate tracking: Use integrated platforms to eliminate manual spreadsheet errors

- Review quarterly: Adjust rates and tiers based on market conditions and team performance

For Account Executives managing complex enterprise deals, commission visibility impacts forecasting accuracy. Teams using AI sales tools report 35% better quota attainment through real-time performance dashboards.

What Tools Help Calculate Commissions Accurately?

Modern sales teams use these approaches:

- Spreadsheet templates: Works for small teams under 10 reps, high error risk

- Dedicated commission software: Specialized tools like CaptivateIQ or Spiff, adds tech stack complexity

- All-in-one GTM platforms: Integrated systems connect sales data with commission tracking automatically

Sales leaders at companies like Predictable Revenue report that consolidating commission tracking into their core sales platform eliminated errors and saved their RevOps team 15+ hours monthly on manual calculations.

Start Calculating Commissions With Confidence

Accurate commission formulas drive sales performance and prevent costly compliance issues. Master the five core structures, implement tiered rates strategically, account for residual revenue in SaaS models, and maintain strict documentation for regulatory compliance.

RevOps teams that automate commission tracking through integrated platforms reduce errors, save time, and give sellers real-time visibility into earnings.

The right commission structure combined with the right tools creates predictable revenue growth. Sales leaders who align compensation with business objectives and provide transparent tracking see measurable improvements in quota attainment and team retention.

Ready to streamline your sales operations and give your team complete visibility into pipeline and performance? Start your free Apollo trial and see how the all-in-one GTM platform consolidates your tech stack while driving revenue growth.

Prove Apollo's ROI In Your First 30 Days

Budget approval stuck on unclear metrics? Apollo delivers measurable pipeline impact from day one—Built-In achieved +10% win rates and +10% ACV. Join 550K+ companies with quantifiable ROI.

Start Free with Apollo →

Kenny Keesee

Sr. Director of Support | Apollo.io Insights

With over 15 years of experience leading global customer service operations, Kenny brings a passion for leadership development and operational excellence to Apollo.io. In his role, Kenny leads a diverse team focused on enhancing the customer experience, reducing response times, and scaling efficient, high-impact support strategies across multiple regions. Before joining Apollo.io, Kenny held senior leadership roles at companies like OpenTable and AT&T, where he built high-performing support teams, launched coaching programs, and drove improvements in CSAT, SLA, and team engagement. Known for crushing deadlines, mastering communication, and solving problems like a pro, Kenny thrives in both collaborative and fast-paced environments. He's committed to building customer-first cultures, developing rising leaders, and using data to drive performance. Outside of work, Kenny is all about pushing boundaries, taking on new challenges, and mentoring others to help them reach their full potential.

Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews