How Much Do Sales Reps Make in 2026?

How Much Do Sales Reps Make in 2026?

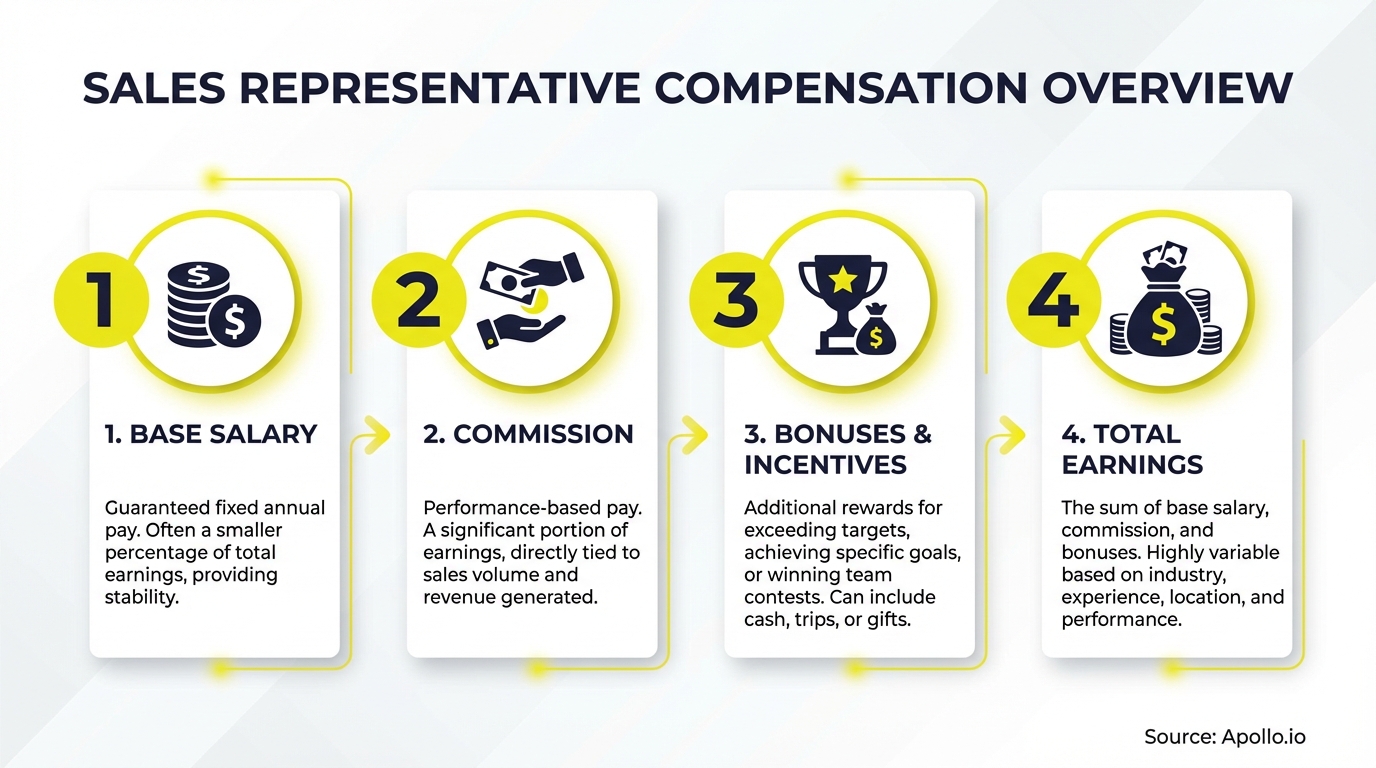

Sales compensation in 2026 reflects a major shift toward incentive-heavy structures and digital-first selling models. Whether you're an SDR booking your first meetings or an AE closing enterprise deals, understanding compensation benchmarks and performance metrics helps you negotiate better packages and maximize your earning potential.

Apollo Eliminates 4+ Hours Of Daily Research

Tired of spending 4+ hours daily hunting for contact info? Apollo delivers 224M verified contacts with 96% email accuracy instantly. Join 550K+ companies who stopped manual prospecting and started closing deals.

Start Free with Apollo →Key Takeaways

- Sales reps earn between $85,000 and $241,500 annually depending on experience level, with incentive-heavy compensation structures driving the highest profitability.

- Salespeople with more than 50% of their pay from incentives generate 8 times more gross profit than those with less than 25% from incentives.

- Digital transformation and rep-free buying preferences are reshaping sales roles, with 61% of B2B buyers now preferring self-service channels.

- Senior sales professionals with over 10 years of experience command total compensation packages exceeding $240,000 in 2026.

- Tool consolidation and automation platforms help sales teams increase productivity and protect compensation during market shifts.

How Much Do Sales Reps Make by Experience Level?

Sales compensation varies dramatically based on experience. Data from the 2024 TechServe Alliance Operating Practices Report shows clear progression paths for sales professionals.

| Experience Level | Base Salary | Incentive Comp | Total Compensation |

|---|---|---|---|

| Early Career (0-2 years) | $60,000 | $25,000 | $85,000 |

| Mid-Level (2-10 years) | $75,000 | $71,600 | $146,600 |

| Senior (10+ years) | $97,500 | $144,000 | $241,500 |

These figures represent B2B sales roles across IT and engineering staffing sectors. Early-career SDRs and BDRs typically start with base-heavy packages as they build pipeline skills. Mid-level Account Executives shift to incentive-focused structures as they take on quota responsibility. Senior sales leaders earn the highest total compensation through strategic account management and enterprise deal closing capabilities.

What Determines Sales Rep Earnings in 2026?

Five primary factors drive sales compensation in today's market:

- Incentive Structure: Reps with 50%+ of pay from incentives generate significantly higher gross profit per person.

- Industry Sector: Sales engineers in technical fields earn median wages of $121,520, while wholesale representatives average $66,780 according to the U.S. Bureau of Labor Statistics.

- Performance Tier: Top 10% earners in wholesale and manufacturing exceed $134,470 annually.

- Digital Adoption: Sales professionals who master automation and AI-powered workflows protect their compensation during market transitions.

- Account Complexity: Enterprise AEs managing multi-stakeholder deals command premium compensation packages.

Struggling to hit quota with outdated prospecting methods? Search Apollo's 224M+ verified contacts with 65+ filters to fill your pipeline faster.

See Every Deal Stage In Real Time With Apollo

Forecasting unreliable because you can't track deal progress. Apollo delivers real-time pipeline visibility across your entire team. Built-In boosted win rates 10% with Apollo's scoring and signals.

Start Free with Apollo →How Does Incentive Mix Impact Sales Rep Profitability?

Compensation structure directly correlates with performance outcomes. Research shows salespeople with more than 50% of their compensation from incentives generate 8 times more gross profit than those with less than 25% from incentives.

| Gross Profit Generated | Percentage of Sales Force |

|---|---|

| Under $750K | 53% |

| $750K - $1.5M | 29% |

| Over $1.5M | 18% |

Most firms require $500,000 in gross profit per sales rep to break even. This benchmark drives compensation design toward performance-based models.

For SDRs and BDRs building pipeline, incentive-heavy structures reward meeting booking and qualification activity. For Account Executives closing deals, variable compensation aligns directly with revenue generation and contract value.

What Compensation Models Work Best for SDRs?

SDRs typically start with 60/40 or 70/30 base-to-incentive ratios during their first year. As they prove consistent meeting-booking capabilities, successful SDRs negotiate toward 50/50 splits.

Top-performing SDRs in tech sectors earn $90,000-$110,000 total compensation by year two through accelerators and overachievement bonuses tied to qualified pipeline generation.

How Is Digital Transformation Changing Sales Compensation?

The shift toward digital-first buying is reshaping sales roles and pay structures. A Gartner survey from June 2025 found that 61% of B2B buyers prefer a rep-free buying experience, forcing sales organizations to rethink traditional field sales models.

This evolution creates three distinct compensation scenarios:

- Hybrid Selling Roles: Reps blend digital outreach with strategic conversations, earning 40-50% of compensation through automation-assisted activities.

- Strategic Account Management: Senior AEs focus exclusively on high-value accounts and complex deals, with base salaries increasing to reflect relationship management responsibilities.

- Digital Sales Specialists: Emerging roles focused on virtual selling and social selling platforms, typically earning $95,000-$140,000 total compensation.

RevOps leaders report that sales teams using unified platforms see more predictable compensation outcomes. As one customer noted, "We reduced the complexity of three tools into one" (Predictable Revenue), allowing reps to focus on revenue activities rather than navigating disconnected systems.

What Role Does Gender Diversity Play in Sales Compensation?

Compensation equity remains a challenge in B2B sales. Women represent only 31% of senior-level B2B sales positions despite making up nearly half of the global workforce.

This representation gap affects both opportunity access and compensation progression for women in sales leadership roles.

Progressive sales organizations address this through transparent compensation frameworks, structured promotion paths, and objective performance metrics. Companies that publish salary bands and incentive structures see improved gender diversity in pipeline and leadership roles.

How Can Sales Leaders Optimize Compensation Structures?

Sales leaders building compensation plans in 2026 should focus on three priorities:

- Incentive Alignment: Structure at least 50% of total compensation through variable pay tied to revenue and profitability metrics.

- Digital Enablement: Invest in consolidated sales platforms that reduce tool complexity and increase rep productivity.

- Transparent Communication: Publish compensation frameworks, quota calculations, and accelerator terms to improve trust and reduce turnover.

Spending too much time on manual data entry instead of selling? Automate your outreach sequences and focus on high-value conversations with Apollo's multi-channel platform.

How Do Top-Performing Sales Teams Structure Compensation?

Elite sales organizations use tiered accelerators that reward overachievement. Once reps hit 100% of quota, they earn 1.5x or 2x commission rates on additional revenue.

This structure drives the highest performers to generate significantly more gross profit while protecting base compensation for developing reps.

Another effective model splits incentives across activity metrics (meetings booked, demos delivered) and outcome metrics (closed revenue, contract value). This balanced approach helps sales development teams maintain pipeline velocity while keeping AEs focused on deal closure.

Maximize Your Sales Earnings in 2026

Sales compensation in 2026 rewards professionals who combine strategic relationship skills with digital-first execution capabilities. Whether you're earning $85,000 as an early-career SDR or $240,000+ as a senior enterprise AE, your total compensation reflects your ability to generate consistent gross profit for your organization.

The most successful sales reps focus on three levers: negotiating incentive-heavy compensation structures, mastering automation tools that increase productivity, and continuously developing skills that command premium pay in evolving markets. As buyer preferences shift toward self-service and digital channels, sales professionals who adapt their approach while maintaining human relationship value will continue to earn top-tier compensation packages.

Ready to increase your sales productivity and protect your earning potential? Schedule a Demo to see how Apollo's all-in-one platform helps sales teams consolidate their tech stack, automate repetitive tasks, and focus on revenue-generating activities that drive higher compensation.

Prove Apollo's ROI In Your First 30 Days

Budget approval stuck on unclear metrics? Apollo tracks every dollar of pipeline impact with built-in ROI dashboards. Customer. io achieved 50% YoY growth with measurable automation returns.

Start Free with Apollo →

Andy McCotter-Bicknell

AI, Product Marketing | Apollo.io Insights

Andy leads Product Marketing for Apollo AI and created Healthy Competition, a newsletter and community for Competitive Intel practitioners. Before Apollo, he built Competitive Intel programs at ClickUp and ZoomInfo during their hypergrowth phases. These days he's focused on cutting through AI hype to find real differentiation, GTM strategy that actually connects to customer needs, and building community for product marketers to connect and share what's on their mind

Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews