MEDDPICC Sales: A Complete Framework for Winning Complex Deals

MEDDPICC Sales: A Complete Framework for Winning Complex Deals

Complex enterprise deals demand more than generic sales tactics. MEDDPICC sales provides a qualification framework that helps Account Executives navigate multi-stakeholder buying processes, identify genuine decision-makers, and forecast deals with precision. In 2026, as Gartner research shows 61% of B2B buyers prefer self-service buying experiences, MEDDPICC helps sales teams adapt to hybrid selling while maintaining deal control.

This methodology transforms how AEs qualify opportunities, from identifying economic buyers to quantifying business pain. Top-performing sales organizations using MEDDPICC report shorter sales cycles and higher win rates by focusing resources on deals with genuine momentum. When integrated with AI sales tools, the framework becomes even more powerful for modern revenue teams.

Apollo Cuts Research From Hours To Seconds

Tired of spending 4+ hours daily hunting for contact info? Apollo delivers 224M verified contacts with 96% email accuracy instantly. Join 550K+ companies who replaced manual prospecting with predictable pipeline.

Start Free with Apollo →Key Takeaways

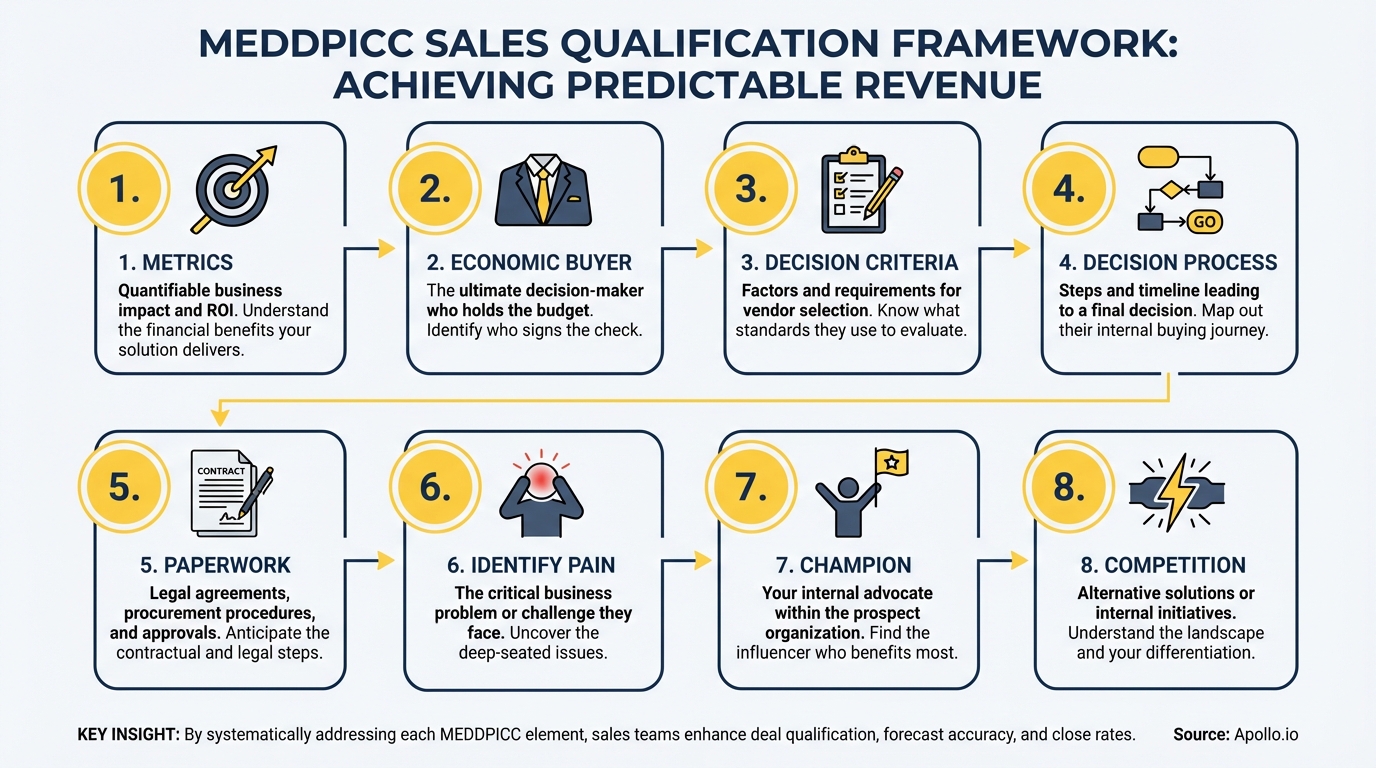

- MEDDPICC qualifies complex B2B deals through eight critical components: Metrics, Economic Buyer, Decision Criteria, Decision Process, Paper Process, Identify Pain, Champion, and Competition

- Account Executives using MEDDPICC improve forecast accuracy by focusing on verifiable deal signals rather than gut feelings or optimistic projections

- The framework adapts to hybrid selling environments where buyers conduct research independently before engaging sales reps

- AI-powered platforms consolidate MEDDPICC qualification data across prospecting, engagement, and deal management in one workspace

- Sales Leaders gain pipeline visibility and coaching opportunities by tracking which MEDDPICC components each deal has validated

What Is MEDDPICC Sales?

MEDDPICC sales is a qualification methodology that evaluates enterprise opportunities across eight dimensions: Metrics (quantifiable impact), Economic Buyer (final decision authority), Decision Criteria (evaluation requirements), Decision Process (buying steps), Paper Process (legal/procurement workflow), Identify Pain (urgent business problems), Champion (internal advocate), and Competition (alternatives being considered). AEs use this framework to determine which deals deserve time investment.

The methodology originated in enterprise software sales where complex buying committees and long sales cycles demand rigorous qualification. Unlike basic BANT (Budget, Authority, Need, Timeline) qualification, MEDDPICC addresses modern buying dynamics where multiple stakeholders influence decisions and procurement processes involve extensive legal review.

For Account Executives managing enterprise sales solutions, MEDDPICC provides a common language for deal reviews. Sales Leaders can quickly identify gaps: a deal with strong Metrics and Pain but no identified Champion carries execution risk, while opportunities with a Champion but unclear Decision Criteria may stall unexpectedly.

Why Do Account Executives Need MEDDPICC in 2026?

Modern B2B buying has fundamentally changed. Research by McKinsey indicates 71% of buyers are comfortable spending over $50,000 through digital channels without sales involvement. This self-directed research means AEs enter conversations later in the buying journey, making qualification frameworks essential for catching up quickly.

MEDDPICC helps sales teams adapt to hybrid selling models that McKinsey research shows can drive up to 50% more revenue. The framework ensures consistency whether AEs engage prospects through video calls, email sequences, or in-person meetings. Each touchpoint should advance understanding of the eight MEDDPICC components.

RevOps teams benefit from MEDDPICC's structured approach to pipeline health. Instead of subjective stage progression, deals advance based on validated information: Has the Economic Buyer confirmed budget?

Does the Champion understand our differentiation versus Competition? This rigor improves forecast accuracy and resource allocation across the sales organization.

Turn Forecast Guesswork Into Revenue Certainty

Missing quota because your pipeline data is always outdated? Apollo gives you real-time deal intelligence and buying signals that make forecasting actually reliable. Built-In increased win rates 10% with Apollo's scoring.

Start Free with Apollo →How Does Each MEDDPICC Component Work?

Effective MEDDPICC implementation requires understanding what evidence validates each component. Here's how top-performing AEs apply the framework:

| Component | What It Measures | Validation Evidence |

|---|---|---|

| Metrics | Quantifiable business impact | Specific ROI calculations, current state vs. future state numbers, financial impact timeline |

| Economic Buyer | Final budget authority | Direct meeting scheduled, confirmed decision authority, budget allocation discussed |

| Decision Criteria | Evaluation requirements | Written evaluation scorecard, weighted priorities, technical requirements documented |

| Decision Process | Buying committee steps | Meeting schedule with stakeholders, approval stages mapped, timeline with dates |

| Paper Process | Legal and procurement workflow | Contract template reviewed, procurement contact identified, security/compliance requirements shared |

| Identify Pain | Urgent business problems | Cost of inaction quantified, current workarounds documented, executive sponsorship for change |

| Champion | Internal advocate with influence | Introduces you to Economic Buyer, shares internal dynamics, coaches on winning strategy |

| Competition | Alternative solutions considered | Competitive vendors named, build vs. buy discussion, status quo assessed as option |

Account Executives should treat MEDDPICC as a discovery roadmap, not a one-time checklist. Early sales conversations focus on Pain and Metrics, while later stages validate Decision Process and Paper Process details.

Struggling to identify the Economic Buyer or Champion early signals a deal that needs repositioning or disqualification.

How Do Sales Leaders Use MEDDPICC for Coaching?

Sales Leaders leverage MEDDPICC during pipeline reviews to identify coaching opportunities. When an AE presents a deal stuck in negotiation, leaders ask: "Have you mapped the complete Paper Process with procurement?" or "Does your Champion have access to the Economic Buyer?" This diagnostic approach pinpoints exactly where deals need attention.

The framework also standardizes new hire onboarding. Instead of learning through trial and error, SDRs transitioning to AE roles understand which qualification questions to ask during discovery calls. This consistency accelerates ramp time and improves early-stage pipeline quality across the entire B2B sales organization.

What Are Common MEDDPICC Implementation Mistakes?

Many sales teams implement MEDDPICC as a rigid checklist rather than a dynamic qualification tool. AEs feel pressure to mark every component "complete" in their CRM, leading to superficial validation.

Saying "Pain identified" without quantifying the cost of inaction or confirming executive urgency creates false pipeline confidence.

Another mistake: treating the Champion component as "nice to have" rather than essential. Deals without an internal advocate who actively sells on your behalf face significantly higher risk.

Your Champion should be able to articulate your value proposition to stakeholders you'll never meet and navigate internal politics on your behalf.

Sales organizations also fail when they don't adapt MEDDPICC to their specific deal complexity. A $10K software sale doesn't require the same Paper Process rigor as a $500K enterprise contract.

Founders and Sales Leaders should calibrate which components matter most for their deal size, sales cycle length, and buyer personas.

How Can AI Enhance MEDDPICC Qualification?

AI transforms MEDDPICC from manual documentation to intelligent automation. Modern platforms analyze email threads, call transcripts, and meeting notes to automatically flag when prospects mention Decision Criteria, Competition, or Pain points.

This eliminates the administrative burden of updating CRM fields after every customer interaction.

Data from McKinsey shows 19% of B2B decision-makers already implement generative AI for buying and selling, with another 23% actively piloting solutions. For AEs, this means AI can surface relevant case studies when a prospect describes Pain, suggest questions to uncover the Economic Buyer, or alert you when a Champion's engagement drops.

Struggling to track MEDDPICC components across dozens of deals? Manage your entire pipeline with AI-powered deal intelligence in Apollo.

The most advanced sales teams combine MEDDPICC discipline with AI sales automation platforms that consolidate prospecting, engagement, and deal management. Instead of jumping between tools to research accounts, send sequences, and update qualification status, AEs work in one workspace. As Census reported after consolidating their tech stack: "We cut our costs in half."

How Do AEs Apply MEDDPICC During Discovery Calls?

Effective discovery calls systematically uncover MEDDPICC components through strategic questioning. Start with Pain and Metrics: "What's the business impact of your current approach?" and "How are you measuring success today?" These open-ended questions reveal whether prospects face urgent problems worth solving.

Transition to Decision Process and Economic Buyer identification: "Walk me through how you've made similar purchasing decisions" and "Who else needs to be involved in evaluating this?" Listen for buying committee composition, approval stages, and budget authority. Strong sales pitch techniques weave these questions naturally into conversation rather than interrogating prospects.

Address Competition and Decision Criteria directly: "What alternatives are you considering?" and "What's most important when you evaluate solutions?" These questions position you as a trusted advisor while gathering intelligence to differentiate your approach. The best AEs also ask about Paper Process early: "What does your typical contract approval process look like?" This prevents late-stage surprises.

Start Applying MEDDPICC to Your Pipeline Today

MEDDPICC sales methodology provides the structure Account Executives need to qualify complex deals, forecast accurately, and allocate time to opportunities with genuine momentum. In 2026's hybrid selling environment, the framework adapts to self-directed buyers while ensuring AEs validate critical deal components before investing significant resources.

Sales Leaders implementing MEDDPICC gain pipeline visibility, coaching consistency, and improved forecast accuracy across their teams. When combined with AI-powered platforms that consolidate your tech stack, the methodology becomes even more effective.

As Cyera's team discovered: "Having everything in one system was a game changer."

Ready to transform your sales process with AI-powered MEDDPICC qualification? Get leads now with Apollo's all-in-one sales platform.

Prove ROI Fast With Real-Time Pipeline Intel

Budget approval stuck on unclear metrics? Apollo delivers measurable pipeline impact from day one with live deal tracking and buying signals. Built-In increased win rates 10% and ACV 10% with Apollo's scoring.

Start Free with Apollo →

Kenny Keesee

Sr. Director of Support | Apollo.io Insights

With over 15 years of experience leading global customer service operations, Kenny brings a passion for leadership development and operational excellence to Apollo.io. In his role, Kenny leads a diverse team focused on enhancing the customer experience, reducing response times, and scaling efficient, high-impact support strategies across multiple regions. Before joining Apollo.io, Kenny held senior leadership roles at companies like OpenTable and AT&T, where he built high-performing support teams, launched coaching programs, and drove improvements in CSAT, SLA, and team engagement. Known for crushing deadlines, mastering communication, and solving problems like a pro, Kenny thrives in both collaborative and fast-paced environments. He's committed to building customer-first cultures, developing rising leaders, and using data to drive performance. Outside of work, Kenny is all about pushing boundaries, taking on new challenges, and mentoring others to help them reach their full potential.

Don't miss these

Sales

Inbound vs Outbound Marketing: Which Strategy Wins?

Sales

What Is a Sales Funnel? The Non-Linear Revenue Framework for 2026

Sales

What Is a Go-to-Market Strategy? The Data-Driven Blueprint That Actually Works

See Apollo in action

We'd love to show how Apollo can help you sell better.

By submitting this form, you will receive information, tips, and promotions from Apollo. To learn more, see our Privacy Statement.

4.7/5 based on 9,015 reviews