Sales Leaders: Your Waterfall Enrichment Strategy Is Costing You Deals

Sales leaders are losing deals to bad data. Learn how waterfall enrichment cuts bounce rates, boosts connect rates, and fixes broken outbound pipelines.

by

Xier Dang

PUBLISHED Feb 5, 2026

Your outbound team just burned through 5,000 leads last month. Half the emails bounced. A quarter of the phone numbers disconnected. Your reps spent more time hunting for accurate contact information than actually selling. Apollo.io explains how waterfall enrichment fixes the data quality problem that's killing your conversion rates.

Key Takeaways

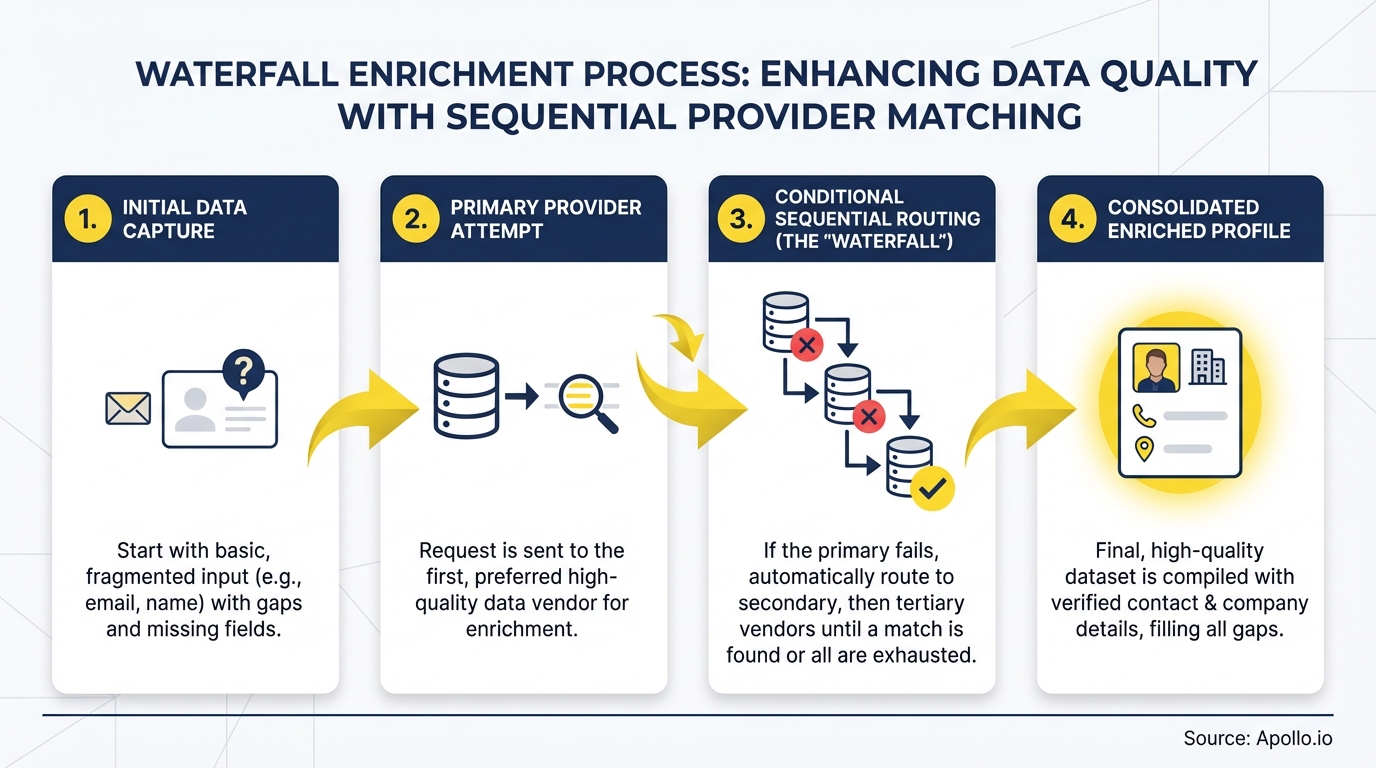

- Waterfall enrichment queries multiple data providers in sequence until it finds accurate contact information, eliminating the guesswork of choosing a single source

- Track email deliverability and phone connect rates instead of vanity metrics like database size to measure enrichment effectiveness

- Evaluate vendors on three criteria: data source diversity, validation accuracy, and workflow integration depth

- Start with a pilot on your highest-value accounts to prove return on investment before rolling out across all territories

- Ask vendors which specific data sources they use and in what order, vague answers about "premium providers" are red flags

What problem does waterfall enrichment actually solve?

Waterfall enrichment solves the single-source data quality problem. When you rely on one data provider, you inherit their gaps.

Provider A has great coverage in tech. Provider B excels at healthcare contacts.

Provider C owns small business data. No single source covers everything.

Your sales team experiences this as wasted activity. A rep researches a prospect online, finds their company, clicks into your customer relationship management system to log the activity, and discovers the email address bounces.

The phone number goes to voicemail at a company that closed two years ago. The job title shows "Sales Manager" when the prospect was promoted to Vice President eighteen months ago.

This creates three specific problems. First, your reps waste time on contacts who will never respond because the information is wrong.

Second, high bounce rates damage your sender reputation, reducing deliverability even for good contacts. Third, your conversion metrics look terrible because you are measuring activity against a database that is 30 to 40 percent inaccurate.

Waterfall enrichment fixes this by checking multiple data sources automatically. When your system needs contact information, it queries Provider A.

If Provider A returns nothing or low-confidence data, the system immediately queries Provider B. Then Provider C.

Then Provider D. The process continues until it finds validated information or exhausts all sources.

The result: Your reps get accurate data without manually checking five different tools. Your bounce rates drop.

Your connect rates improve. Your conversion metrics finally reflect actual performance instead of data quality problems.

What metrics should you track for waterfall enrichment?

Track email deliverability and phone connect rates, not database size. A database with 10 million contacts means nothing if half the emails bounce and a third of the phone numbers are disconnected.

Start with email deliverability. Measure your bounce rate before implementing waterfall enrichment.

Then measure it monthly after implementation. You should see bounce rates drop to under 5 percent.

Anything above 8 percent indicates either poor data validation or sources that are not refreshing frequently enough.

Next, track phone connect rates. This measures how often a human answers when your reps call.

Before waterfall enrichment, most teams see connect rates around 3 to 5 percent. After implementation with proper validation, you should reach 8 to 12 percent.

The improvement comes from two factors: more accurate numbers and better mobile versus office line identification.

Monitor your data coverage rate. This measures what percentage of your target accounts actually receive enriched data.

If you are enriching 100 accounts and only 60 get updated information, your coverage rate is 60 percent. Look for solutions that achieve 85 percent or higher coverage across your specific industries and geographies.

Track time to enrichment. How long does it take from identifying a target account to having actionable contact data?

Manual processes take hours or days. Effective waterfall enrichment delivers validated data in seconds.

Measure this as average hours from account entry to first outreach. Reduce this metric aggressively, every hour of delay is a lost opportunity.

Finally, measure cost per validated contact. Total your enrichment spending and divide by the number of contacts that actually resulted in conversations. This reveals whether you are paying for database bloat or actual sales opportunities. According to McKinsey research on B2B growth, companies that focus on data quality over data volume achieve significantly better return on investment from their sales technology investments.

What questions should you ask waterfall enrichment vendors?

Ask which specific data providers they use and in what order. Vendors who answer "we use premium sources" or "we partner with leading providers" are hiding something.

You need to know exactly which sources feed the waterfall because each has different strengths and weaknesses.

Press for the provider sequence. Does the system check your existing customer relationship management data first?

Does it prioritize real-time web scraping over static databases? Can you customize the order based on your industry?

The sequence matters because it affects both speed and accuracy.

Ask about validation methods. How does the system verify an email address actually works before returning it?

How does it distinguish between a valid phone number and one that has been reassigned? Look for vendors using real-time SMTP verification for emails and carrier lookup for phone numbers.

Batch verification that happens once a month is not enough.

Question their refresh rates. How often does each data source update?

If a contact changes jobs, how long until the system reflects that change? The best solutions incorporate job change alerts and real-time signals, not quarterly database refreshes.

Probe integration depth. Does the enrichment happen automatically when reps add a contact, or do they need to remember to click an "enrich" button? Can it enrich data in bulk for existing lists? Does it sync bidirectionally with your customer relationship management system? Surface-level integrations create more work, not less.

Ask about coverage limitations. Where does their data work well and where does it fall short?

Every vendor has geographic, industry, or company size gaps. Honest vendors will tell you upfront.

Dishonest ones will promise universal coverage and underdeliver.

Finally, demand transparent pricing. Is it per contact enriched, per record stored, or per user?

Are there overage fees? What happens if you exceed your monthly limit mid-quarter?

Vendors with complicated pricing structures are usually hiding the true cost.

How do you evaluate if waterfall enrichment is working?

Run a controlled test on a segment of your database. Take 500 target accounts.

Enrich half using your current process. Enrich the other half using waterfall enrichment.

Track bounce rates, connect rates, and conversations generated over 30 days.

The waterfall-enriched segment should show measurably better performance. If bounce rates drop by 40 percent or more, the solution is working.

If connect rates improve by 50 percent or more, the validation is effective. If you see no significant difference, either the implementation is wrong or the vendor is not delivering.

Survey your reps after 60 days. Ask three specific questions.

First, how much time do you save per prospect now versus before? If they cannot quantify this, the solution is not making a difference.

Second, how often do you encounter bad data now versus before? If they are still manually correcting emails and phone numbers regularly, something is broken.

Third, would you go back to the old process? If the answer is anything other than an immediate no, you chose the wrong solution.

Review your sender reputation scores. Email service providers track bounce rates, spam complaints, and engagement.

If your scores improve after implementing waterfall enrichment, you are protecting your domain reputation. If they stay flat or decline, your validation process is not working.

According to Forrester's research on B2B revenue operations, companies that implement systematic data quality processes see measurable improvements in pipeline velocity and conversion rates within the first quarter.

What actually breaks during waterfall enrichment implementation?

Data conflicts break first. Your customer relationship management system has one email address.

The waterfall returns a different one. Which is correct?

Without clear conflict resolution rules, your reps default to manual research, exactly what you are trying to eliminate.

Set explicit precedence rules before implementation. For example: Manually verified contacts always take priority. Recent job change alerts override static database entries. Customer relationship management data older than six months gets overwritten automatically. Without these rules, enrichment creates confusion instead of clarity.

Integration depth breaks next. Surface-level integrations require reps to remember extra steps.

They need to click an enrichment button. They need to wait for results.

They need to manually update fields. Each friction point reduces adoption.

Look for solutions that enrich automatically in the background as reps work.

Provider conflicts create problems. Two sources return different phone numbers for the same contact.

How does the system decide which to use? Basic waterfall implementations just take the first result.

Better solutions cross-reference multiple sources and flag conflicts for review. Best-in-class systems use confidence scoring to automatically select the most reliable data.

Cost overruns surprise finance teams. You budgeted for enriching new contacts.

Then someone enriches your entire existing database. Suddenly you are paying for 100,000 enrichment requests instead of 5,000.

Set clear governance around who can enrich what and implement approval workflows for bulk operations.

Data decay continues even after enrichment. A contact who had accurate information in January changes jobs in March.

Your system still shows the old company. Effective waterfall enrichment includes ongoing monitoring and automatic updates, not one-time fixes.

How do you make the waterfall enrichment decision?

Start by auditing your current data quality. Calculate your email bounce rate, phone connect rate, and percentage of incomplete records.

These numbers establish your baseline and justify the investment. If your bounce rate is under 5 percent and connect rate is above 12 percent, you might not need waterfall enrichment yet.

Define your coverage requirements. Which geographies matter most?

Which industries? What company sizes?

Match these requirements against each vendor's proven strengths. A vendor with excellent North American tech coverage might struggle with European healthcare data.

Test with real data before committing. Most vendors offer pilots or trials.

Give them 100 of your hardest-to-enrich accounts. Accounts where your current tools fail.

Accounts in industries or regions where you struggle. See which vendor delivers the highest coverage and accuracy on your actual use case.

Calculate cost per conversation, not cost per contact. A solution that costs twice as much but doubles your connect rate delivers better return on investment than a cheap solution with mediocre data.

Factor in rep time saved, sender reputation protection, and opportunity cost of bad data.

Verify the implementation process. How long does setup take?

Do you need engineering resources or can sales operations handle it? What breaks during the transition?

Get specific timelines and resource requirements in writing before signing.

Check customer references in your specific situation. If you are a 50-person startup selling to mid-market, talking to enterprise customers with dedicated data teams tells you nothing useful.

Ask vendors for three references that match your company size, industry focus, and technical sophistication.

Review the contract flexibility. Can you add data sources later?

Can you adjust your volume up or down quarterly? What happens if a key data provider leaves their network?

Lock in provisions that let you adapt as your needs change.

The decision comes down to three factors: data quality improvement, operational efficiency gain, and total cost of ownership. If a solution measurably improves your key metrics, saves your reps significant time, and costs less than the revenue impact of bad data, implement it.

If it fails any of those tests, keep looking.

Subscribe for weekly updates

Receive insider stories and data-backed insights for elevating your work and staying ahead of the curve

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.