How is Intent Data Collected? Here's Everything You Need to Know

Where does buying intent data come from? How do data companies find and collect it? Is B2B intent data a true indicator of purchase intent?

These are all common questions in the intent data space. After all, intent data is a relatively new and emerging product category and many companies are still trying to understand how it fits into their lead generation strategy.

So, before even thinking about investing your dollar in a new data provider, you should feel comfortable in your understanding of intent data and feel assured that these intent indicators are being collected accurately and ethically.

In this blog, we'll give you the basics of buying intent data and uncover the mystery of exactly how data providers find buyer signals and convert them into tidy bits of information that propel your sales forward.

Here's what we'll cover:

- What is buying intent data?

- Why intent data matters for sales teams

- Types of intent data

- How is intent data collected?

- Frequently asked questions about intent data collection

A recap: what is buying intent data?

Let's say, for example, that you sell gym memberships…

A big part of your job is hunting for prospects who are looking to get fit and join a new community. You could start by cold calling every prospect on your target list, but joining a gym (and nearly every other purchasing decision) is all about timing. What if you were able to identify the contacts who are eager to join a gym right now? You'd save time, waste fewer resources, and close even more deals.

By leveraging intent data, you can.

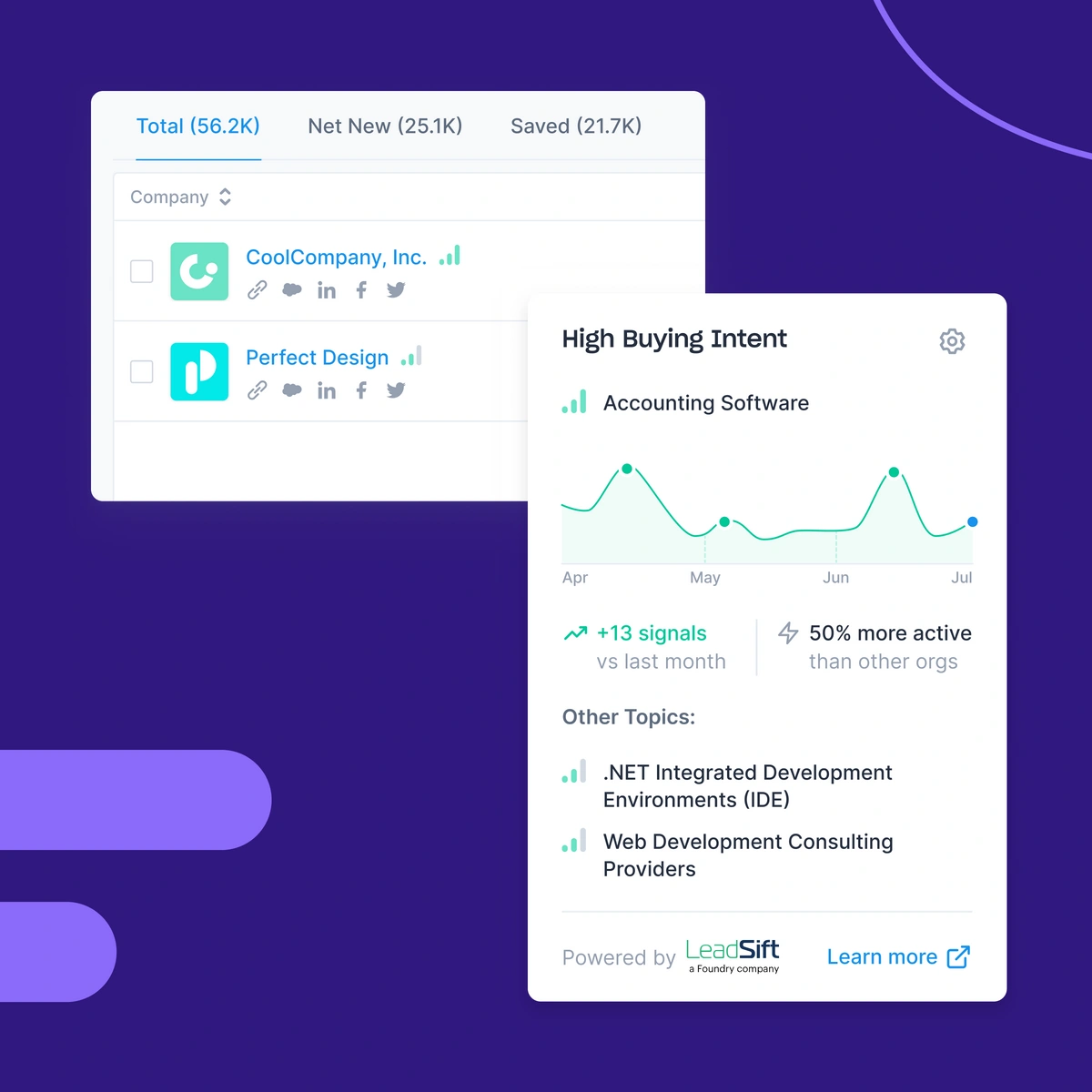

Intent data (often called buyer intent data or purchasing intent data) is a collection of behavioral signs – specifically web content consumption – that help sellers determine a prospect's purchase intent. It is a set of signals that reveals which leads or accounts are actively researching on first and/or third-party sites.

When people have a problem, all they need is a device and some wifi to find answers and solutions. Looking for a dog walker? Need to find top-rated running shoes? Searching for new software? Google's got you.

That's why buying intent is so powerful. Sellers can target buyers that are already searching for solutions like theirs, getting them that much closer to a sale than if they were targeting blindly.

There are two main types of intent data that sellers can use to determine buying intent:

First-party intent data is insights from your own users and prospects. It includes the data collected from your website and platforms (think: form fills, website tracking, chatbots, etc).

Third-party intent data is insights and signals from digital spaces outside of your own gathered by external providers. A third-party intent signal might look like a contact commenting in a web forum on a topic that's related to your industry or engaging with a video in your product category. These signals help you identify new prospects before they reach your site (or your competitor's).

Subscribe for weekly updates

Why intent data matters for sales teams

It's not about working harder; it's about working smarter. Intent data helps you stop guessing and start engaging with prospects who are already looking for a solution like yours. It's a critical tool for modern sales teams for a few key reasons:

- Prioritize the right accounts: Focus your energy on leads who are actively researching solutions, not on those who aren't ready to buy.

- Improve timing and relevance: Reach out at the exact moment a prospect is considering a purchase, making your message more impactful.

- Personalize your outreach: Use insights about what a prospect is researching to tailor your messaging to their specific pain points.

Ultimately, this means you'll save time, shorten your sales cycle, and close more deals by focusing your energy where it counts.

Types of intent data

Not all intent data is created equal. Understanding the different types helps you build a smarter outreach strategy. Here's the breakdown:

First-party intent data

This is the data you collect yourself from your own digital properties. Think website visits, content downloads, pricing page views, and email engagement. It's highly accurate because it comes directly from your audience, but it only gives you a view of prospects who already know you exist.

Third-party intent data

This is the game-changer. It's behavioral data gathered from across the web by providers like Apollo. It tracks what content prospects are consuming on other websites, forums, and review sites. This gives you a massive advantage by revealing accounts that are in-market for a solution before they've ever landed on your site.

How is intent data collected?

The logistics of collecting first-party data are pretty straightforward. But how do these third parties collect these magical intent numbers from all across the web?

Well, intent data is collected in several different ways:

- Data gathered from website traffic (e.g. users or accounts who have visited relevant websites and therefore have shown intent)

- Data based on online advertising engagement

- Data based on content consumption

- Data that reflects relevant online research across search engines, forums, blogs, social channels, etc.

Data from software review sites (e.g. pages visited, reviews written) - Any of the above layered with valuable contextual information like new job hirings, press mentions, funding rounds, referral sources, etc.

Turn intent signals into sales success with Apollo

Knowing who's ready to buy isn't a luxury anymore—it's a necessity. When buyers do most of their research before ever talking to a seller, you need a way to get in front of them early. That's where intent data comes in.

By teaming up with an intent data provider like Apollo, you get the buyer intelligence you need to stop prospecting in the dark and start selling with confidence. Find in-market accounts, personalize your outreach, and convert at scale. Ready to see how it works? Get Started with a free account.

Frequently asked questions about intent data collection

What counts as an 'intent signal'?

An intent signal is any trackable online action that suggests buying interest. This can include a prospect downloading a competitor's case study, commenting on a relevant LinkedIn post, visiting a pricing page, or searching for specific keywords. These signals are often scored, so a demo request would be weighted more heavily than a simple blog view.

What is an example of intent data?

Imagine you sell project management software. An intent signal could be a key contact at a target account downloading a whitepaper on “improving team productivity” from an industry blog. Another example is multiple employees from the same company suddenly researching your competitors on a software review site. These actions signal a problem they're trying to solve right now.

What is the accuracy of intent data?

Good intent data providers use zero guesswork. Every signal you receive is based on a real action that happened. The effectiveness, however, is determined by your strategy. The data is accurate, but you need to contextualize it and act on it quickly to get the results you want.

After it's been collected, does it go stale?

Like all data, buying intent insights decay over time. A signal from today is far more valuable than one from six months ago. That's why it's important to choose a data provider that frequently crawls the web for the most current info and regularly enriches existing data.

Is all of this GDPR compliant?

Yes, collecting intent data as a practice is absolutely within general data protection regulations (GDPR), but it's crucial to partner with a compliant provider. Always ask potential providers about their data collection practices and privacy policies to ensure your company is teaming up with an ethical and secure partner.

Share this post

Start using Apollo today

Start your free trial with Apollo today—then use these resources to guide you through every step of the process.

Start using Apollo today

Start your free trial with Apollo today—then use these resources to guide you through every step of the process.

or

By signing up, I agree to Apollo's Terms of Service and Privacy Policy.

Continue Learning

Explore these handpicked resources to deepen your understanding of AI-powered GTM